You and your spouse are under 65 years old at the end of 2015.Your filing status is single or married filing jointly.Your taxable income is less than $100,000.The graphic below shows the line on which the payments should be reported (Part IV, line 6).Which Form to choose: 1040EZ? 1040A? or 1040?

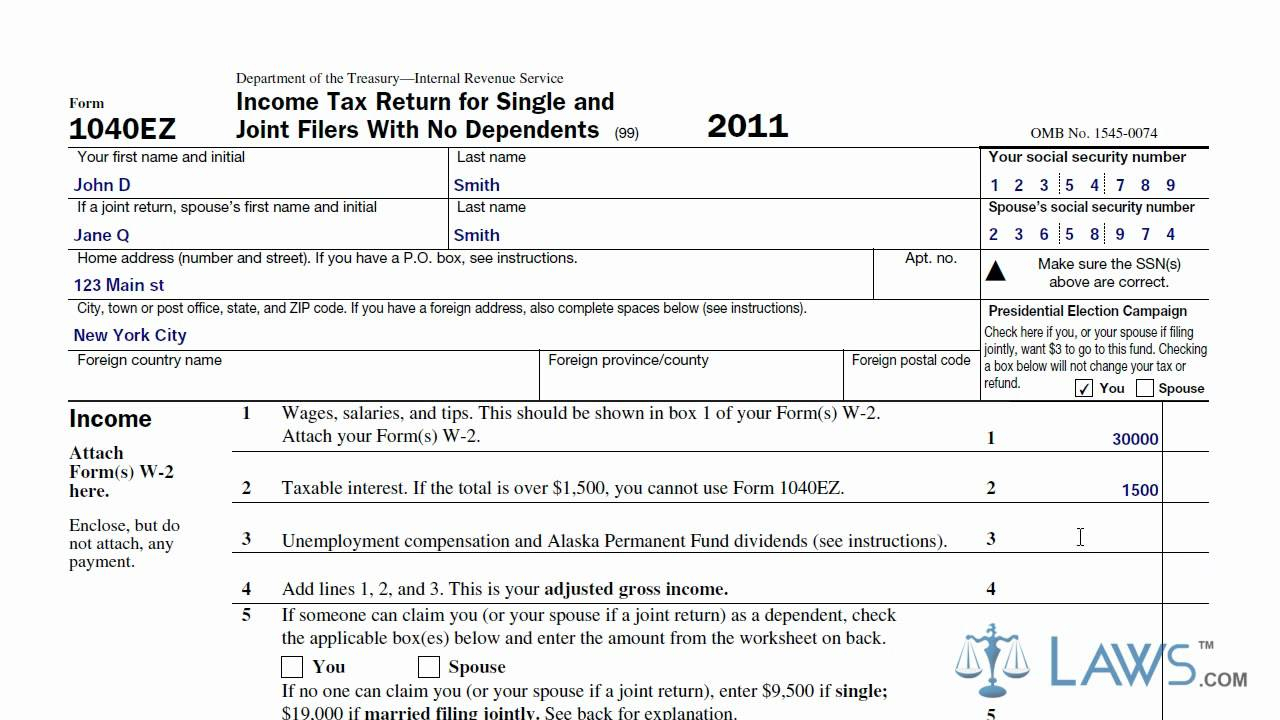

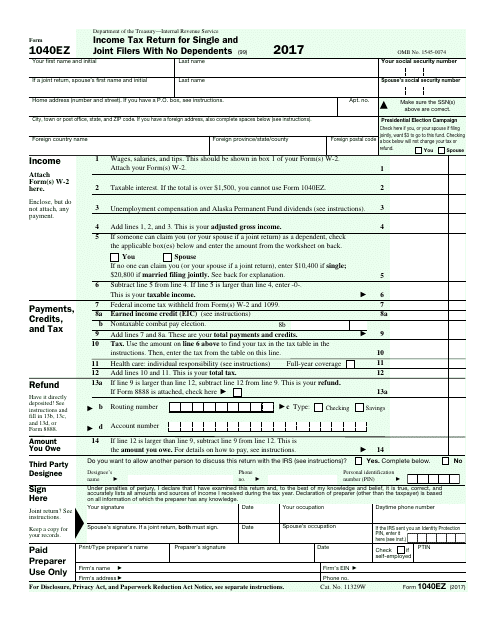

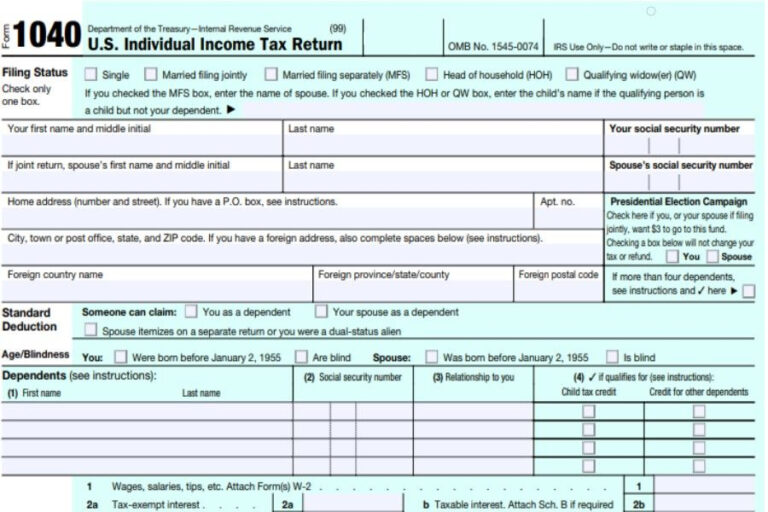

How to Report (State of Alabama)Īs for reporting the income, the State of Alabama tax form does require disclosure of the payments, but they should be qualified as scholarship/fellowship payments. This information is taken directly from the Alabama Administrative Code (810-3-14-.02 Exclusions from Gross Income). If the taxable amount was not reported on Form W-2, enter "SCH" and the taxable amount on the dotted line next to line 7. If you file Form 1040, report the taxable amount on line 7. If the taxable amount was not reported on Form W-2, enter "SCH" and the taxable amount in the space to the left of line 7. If you file Form 1040A, report the taxable amount on line 7. If the taxable amount was not reported on Form W-2, enter "SCH" and the taxable amount in the space to the left of line 1. If you file Form 1040EZ, report the taxable amount on line 1. How you report any taxable scholarship or fellowship income depends on which return you file. Following is the information on where to report fellowship payments on the 1040 Internal Revenue Service Forms as defined by IRS publication 970.Assistance in determining how to report these payments is available in most online filing software.Download instructions for accessing payslips. Copies of payslips may be accessed through Oracle Self Service. Trainees in this category should retain their 31DEC20XX payslip for a record of the year-to-date information.citizens are reportable to the federal government. Trainee/Fellowship payments made to US citizens or RA taxed as U.S.The 1098T is issued by UAB Student Accounting. Exception: Trainee/Fellowship payments made through UAB Payroll Services to UAB students are reported on the 1098T form provided there were tuition, scholarship or other qualified payments posted to the student account.Exception: Trainee/Fellowship payments made to a NRA with NRA Tax ramifications are subject to 1042S reporting requirements.Trainee/Fellowship payments are not reported to any tax agency.The following are points that you should consider when completing the required tax documents. Fellowship payments have specific tax reporting requirements for federal and Alabama state filings. The term trainee payments is used by the University, but defined by the IRS as a fellowship payment.

0 kommentar(er)

0 kommentar(er)